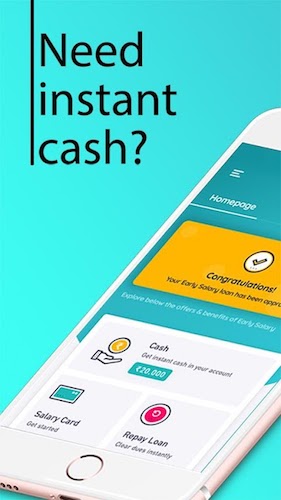

Do you find yourself in the midst of a financial crisis at the end of every month? Or does your bank account look empty when you need money for something really important? Maxed out your credit card just before that romantic date you’ve been planning all month? Then EarlySalary is just what you need as a short term solution to your financial crisis.

EarlySalary

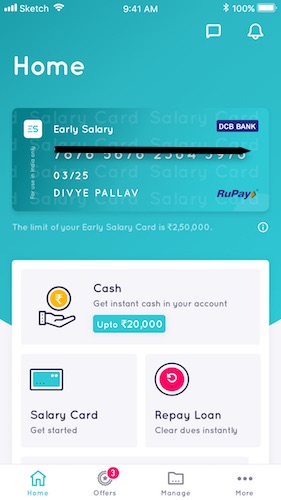

From the name EarlySalary, you guessed right that you will get your Salary early, not from your boss or organization, but from the FinTech consumer lending startup EarlySalary. EarlySalary provides a line of credit or Instant loans to young working professionals. The company will reach the funds you need, instantly to your bank account and offer you easy pay-back options.

A short-term loan of a small amount is provided to salaried individuals using the EarlySalary App. The company has disbursed loans of INR 550 crores till date and has over 7 million users in India. EarlySalary conducts risk assessment from data available through its users, keeping track of spending and lifestyle habits to determine loan disbursement and qualify loan amounts for different users.

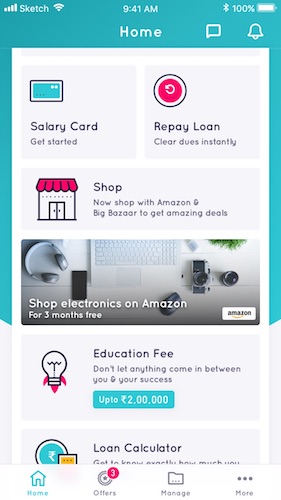

EarlySalary allows you to shop on your favorite online sites like Amazon, Flipkart, Big Bazaar and other retailers, via their app and also offers interest free EMIs on purchases. This is a big plus point for consumers like you. So if you run out of money and there’s a big Sale on any of these platforms, you don’t need to curb your inner shopaholic, just log on to EarlySalary and shop to your hearts content.

The company also has over 200 tie ups with corporates for instant salary advances to their employees. These advances are offered without prior documentation and at very low interest rates. The startup is using various ways of reaching out to consumers, more prominently Digital channels. Debt is friendly if you need for a short duration, and you are able to repay it easily. It can be your friend in case of emergency and for leisure activities too.

Why use EarlySalary?

Young working professionals do require money at the end of the month. Its the week just before the salary arrives. So to sustain on such critical days, you can surely go for EarlySalary and opt for an Instant line of credit. This will help you enjoy meals in your favorite restaurants or go on that exquisite Date. Well, the founder did start the company since he realized that millennials cannot afford to go on dates at the end of the month.

Young professionals also do a lot of short and impulsive trips that are planned at the spur of the moment. To finance such plans you can apply to EarlySalary when your bank account gets empty. Just use the app and in minutes you can get the required credit according to your Social Score.

Banks provide loans on the basis of credit score, but EarlySalary has a unique parameter called a Social Score. This is calculated with the help of AI and the data taken from the user.

There are many reasons for opting for EarlySalary- travel, dinner parties, clubbing, dating, shopping and many more. Also the best part is that there are no questions asked about why you need the money. This is an amazing aspect as it helps secure your privacy. It’s basically a personal loan for your personal use.

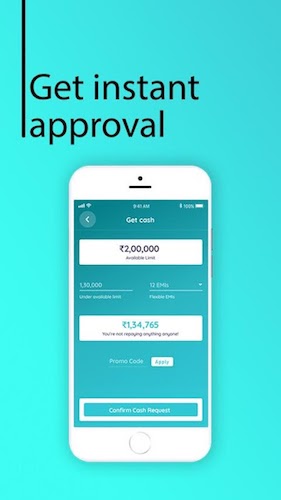

Another advantage is that there is no credit history required in the app. So they don’t want to know if you have repaid any loans in the past. They just check your financial statements to check your credit score for the eligibility of the instant loan. You can get Personal loans upto INR 2 lakhs according to your eligibility wherein, the loan repayment tenure is as short as upto 3 months.

Its earier to take a salary advance today rather than taking a personal loan.

How to use EarlySalary App?

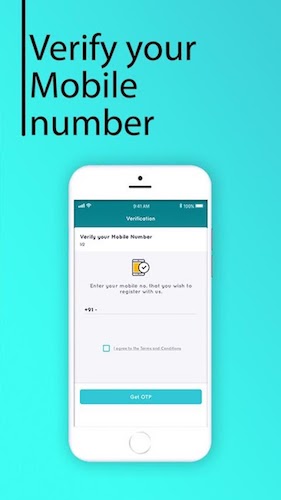

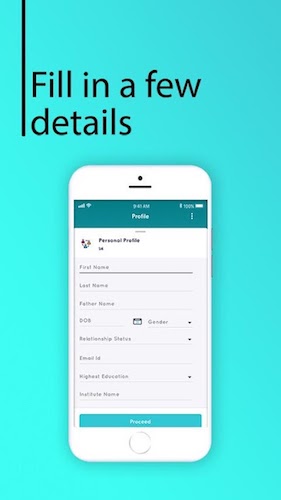

Using the EarlySalary is very simple. Just download the Free App from the Google Play Store for the Android users or from iTunes store for the iOS users. First step is to verify your mobile number. So, enter your mobile number and you will get an OTP (One Time Password). Once you key in the OTP you will be registered to the app. Then the app asks you a set of questions.

Fill up all the details and wait for the magic to happen. The company’s AI understands your Social Score (credit score and your details). The company does need access to your bank statement to understand your eligibility of the limit of the instant loan. Then you can confirm cash request and just sit back and wait for the amount to be credited into your bank account. You can also shop on Amazon, Flipkart and Big Bazaar and pay later and get upto 6Months No Cost EMI and works much better than a credit card.

This whole process happens in minutes, but can only be used by working salaried professionals. The credit score is calibrated according to the user’s salary and the available loan limit is decided by the app.

Wrapping Up

EarlySalary can be your companion in a financial crisis at the end of the month. You can give it a try if you are short of cash at the end of the month. Working salaried professionals can get instant loans at a very low interest rate. If you take an instant loan of INR 2,00,000 then the interest rate is just INR 9 per day. This is even lower than the interest rate on credit cards. So what are you waiting for, Download the app and get your EarlySalary now!

Nikhil Narkhede

Latest posts by Nikhil Narkhede (see all)

- Best Free Video Editing App for Android - April 17, 2024

- Stuffcool Revel Magnetic Wireless Charger – Qi2 Launched - April 16, 2024

- How to Restart OnePlus Nord CE 3 - April 15, 2024

I have salary of 20,000 per month. Cab i use the app? Need some funds before this year end.

You can certainly use the app. Install it and fill the forms. If not approved you can ask their support for the reason. If you have proper documentations, no need to worry. Though there might be some guidelines or limit for requesting loan